-

Sign up to receive insights in your inbox

-

Article Link

July 11, 2025

Cognito’s That’s What You Think Podcast #1: Ben Ford on the Evolution of Open Banking in Australia

Read More -

Article Link

July 9, 2025

Jennifer Riggins: The Human Side of Tech – AI Should Enhance, Not Replace, Developer Creativity

Read More -

Article Link

May 20, 2025

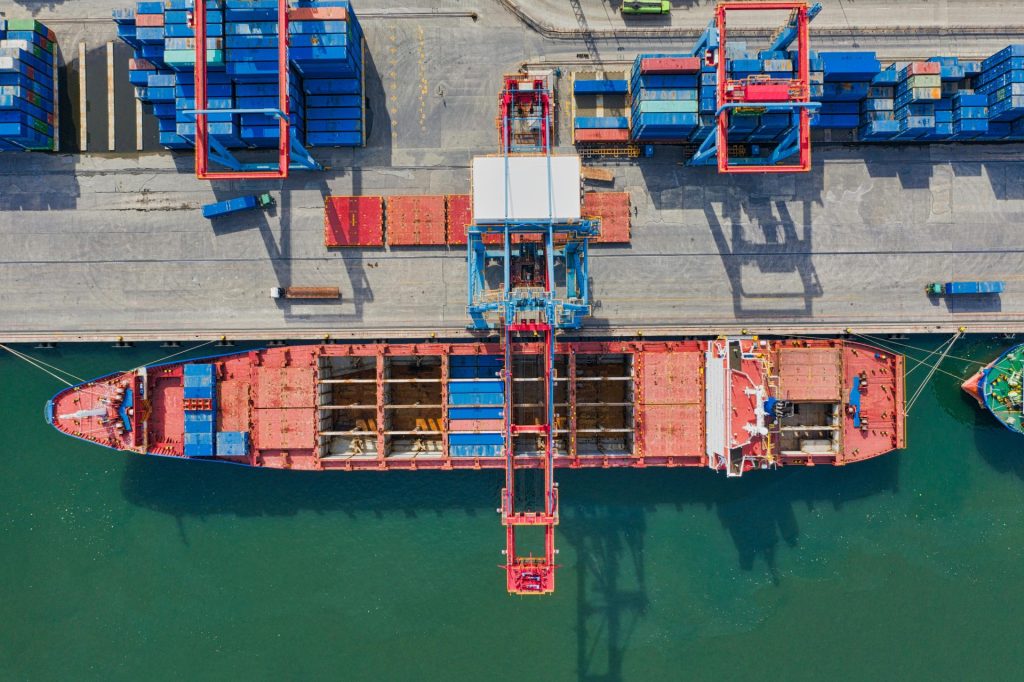

Hong Kong surges, Singapore retreats: How to turn IPO divergence into a media moment

Read More -

Article Link

April 16, 2025

Esther Shittu: Demystifying agentic AI and finding the real stories behind the hype

Read More -

Article Link

April 1, 2025

Why competitor analysis should be a non-negotiable while building your PR strategy

Read More -

Article Link

April 1, 2025

Klarna IPO Day 12 – what the media reception says about fintech press and PR

Read More

News and views

Our consultants share their expertise on the issues that matter most.